5 min read

Hyperliquid: Redefining Decentralized Trading

The premier DEX experience

Introduction

Hyperliquid’s meteoric rise is a web3 revolution in its truest sense. The space, largely dominated by centralized providers, is now moving from low-liquidity experiments to a high-throughput platform that directly challenges centralized exchanges. Behind this success lies the consensus mechanism tailored to web3 trading, a clear understanding of user needs, and a transparent community-first approach.

Built from first principles with a custom Layer-1 blockchain, Hyperliquid fuses the speed and experience of a centralized exchange with the auditability and self-custody of DeFi.

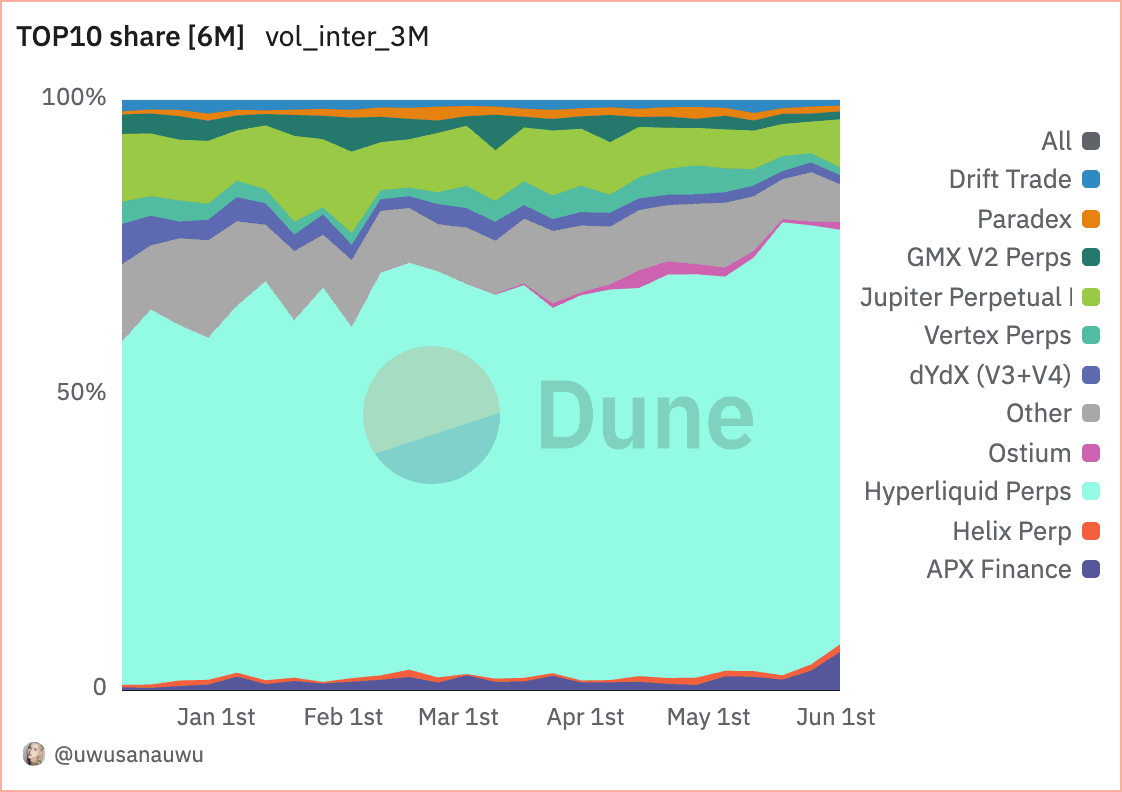

In under a year, Hyperliquid has grown from relative obscurity to processing over $244 billion in monthly volume. That’s 10% of Binance’s derivatives volume—an unprecedented feat for an on-chain exchange. It reflects a system purpose-built for high-frequency trading, reinforced by a novel consensus mechanism, a fully on-chain order book, and a user experience free of gas fees, while being completely self-custodial.

The Special Consensus: HyperBFT

Hyperliquid’s engine room is powered by HyperBFT, a proprietary consensus algorithm inspired by Hotstuff and tailored for the demands of real-time trading. This hybrid consensus model combines Proof-of-Stake (PoS) with Byzantine Fault Tolerance (BFT), enabling:

-

Median block times of 0.07s

-

Sub-second transaction finality

-

Continuous sequencing of orders and trades

Unlike most Proof-of-Stake chains that optimize for general-purpose smart contract execution, HyperBFT is laser-focused on throughput and determinism. The design supports up to 200,000 orders per second, matching the latency sensitivity of professional trading environments. Every single trade is finalized in one block, giving users verifiable assurance of their fills without waiting or reorg risk.

The validator active set currently stands at 21, with a roadmap to expand further. Validators are in the active set based on HYPE token stake, and while some raised centralization concerns, this number has been limited to stabilize the network, leading to a slow and steady launch into the mainstream. Efforts and actions are already underway, with Luganodes recently joining the active validator set.

Offerings: Perpetuals and Spot Trading

Hyperliquid’s initial focus was on perpetual futures—synthetic contracts without expiry—where it now leads the DEX market.

Traders can access over 130 assets with up to 50x leverage and benefit from advanced order types such as:

-

Limit / Market orders

-

Stop Market / Stop Limit

-

Scale orders

-

Time-Weighted Average Price (TWAP)

With the release of HyperEVM, the platform introduced Ethereum-compatible smart contracts. The dual-stack architecture—HyperCore for trading, HyperEVM for extensibility—has broadened its utility far beyond derivatives. Projects can now build on Hyperliquid with the same efficiency and composability seen on established L1s, but with the speed of a trading-native chain.

All trades incur zero gas fees. Users only pay when withdrawing assets.This zero-friction model is a major draw for both casual users and high-frequency traders, who are otherwise price-sensitive to execution costs.

Just like DEXs, the KYC procedure is eliminated. allowing traders to connect their wallets and commence trading without divulging personal information. The platform also prioritizes user-friendliness with features like one-click trading, streamlining the trading process.

Hyperliquid embraces the foundational values of DeFi—self-custody, user ownership, and transparent execution. Traders retain full control of their funds at all times, with no intermediaries, custodians, or other friction.

The Hyperliquidity Provider (HLP) vault is another feature, enabling users to provide liquidity and earn profits from integrated market-making strategies. Therefore, democratizing a strategy usually reserved for privileged parties on most exchanges. HLP is still only one of many participants in the orderbook, where many more makers are participating in the open and permissionless system.

The Orderbook: Fully On-Chain CLOB

The majority of DeFi exchanges still rely on Automated Market Makers (AMMs), which pool liquidity and use bonding curves to determine price. AMMs work—but they struggle with price precision, slippage, and high-frequency execution.

Hyperliquid chose a different path: a fully on-chain Central Limit Order Book (CLOB). Every bid, ask, fill, and cancellation is on-chain, verifiable, and instantly settled. There are no hidden match engines or privileged actors. What you see in the order book is what gets matched.

This transparency eliminates frontrunning risk, allows for advanced order logic, and replicates the experience of professional trading desks—something previously limited to CEXs.

The HYPE Token: Ecosystem Utility and Incentive Design

HYPE is the native utility token of the Hyperliquid ecosystem—used not just for governance or staking, but embedded into nearly every protocol function. With no private or VC allocations, its distribution model focuses entirely on community growth.

Key roles of HYPE include:

-

Governance: Enables token holders to vote on key protocol decisions.

-

Staking: Powers the validator set under HyperBFT, with emissions-based rewards and security alignment.

-

Gas Token: Used for smart contract execution on HyperEVM.

-

Fee Discounts & Market Deployment: Grants trading discounts and is required to launch new markets, aligning incentives and deterring abuse.

Additionally, protocol revenues are funneled into a buyback-and-burn mechanism via the Assistance Fund, progressively reducing HYPE’s circulating supply. In short, HYPE isn’t a passive asset—it’s a structural part of the protocol’s economic and governance machinery.

Conclusion

Hyperliquid’s innovation has gone beyond being just another DEX—it’s a purpose-built financial engine redefining how markets operate on-chain. With its own high-performance Layer-1, transparent infrastructure, and a community-first token model, it’s creating a fundamentally better experience for traders and developers alike.

As Jeff Yan, co-founder of Hyperliquid, put it: the goal is not incremental change but a full-scale upgrade to the financial system—"transparent, 24/7, low latency, auditable." Hyperliquid is positioning itself as the platform where this vision can become reality.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.