7 min read

Avalanche in Motion: Data, Subnets, and Institutional Adoption

The Avalanche Evolution

Introduction

Avalanche began as a highly scalable blockchain platform, praised for its sub-second transaction finality and flexible architecture. In the past two years, however, the network has moved beyond its foundational promise to become a robust and highly active multi-chain ecosystem. The story of Avalanche today is no longer about “Ethereum competition” but about the rise of Subnets, institutional adoption, and the tangible impact of tokenized assets.

The ETNA Upgrade: Avalanche’s Breakthrough Moment

Avalanche’s most ambitious overhaul arrived with the Avalanche9000 (Etna) upgrade in late 2024, its largest technical change since launch. More than just an optimization, Etna redefined how developers interact with the network by:

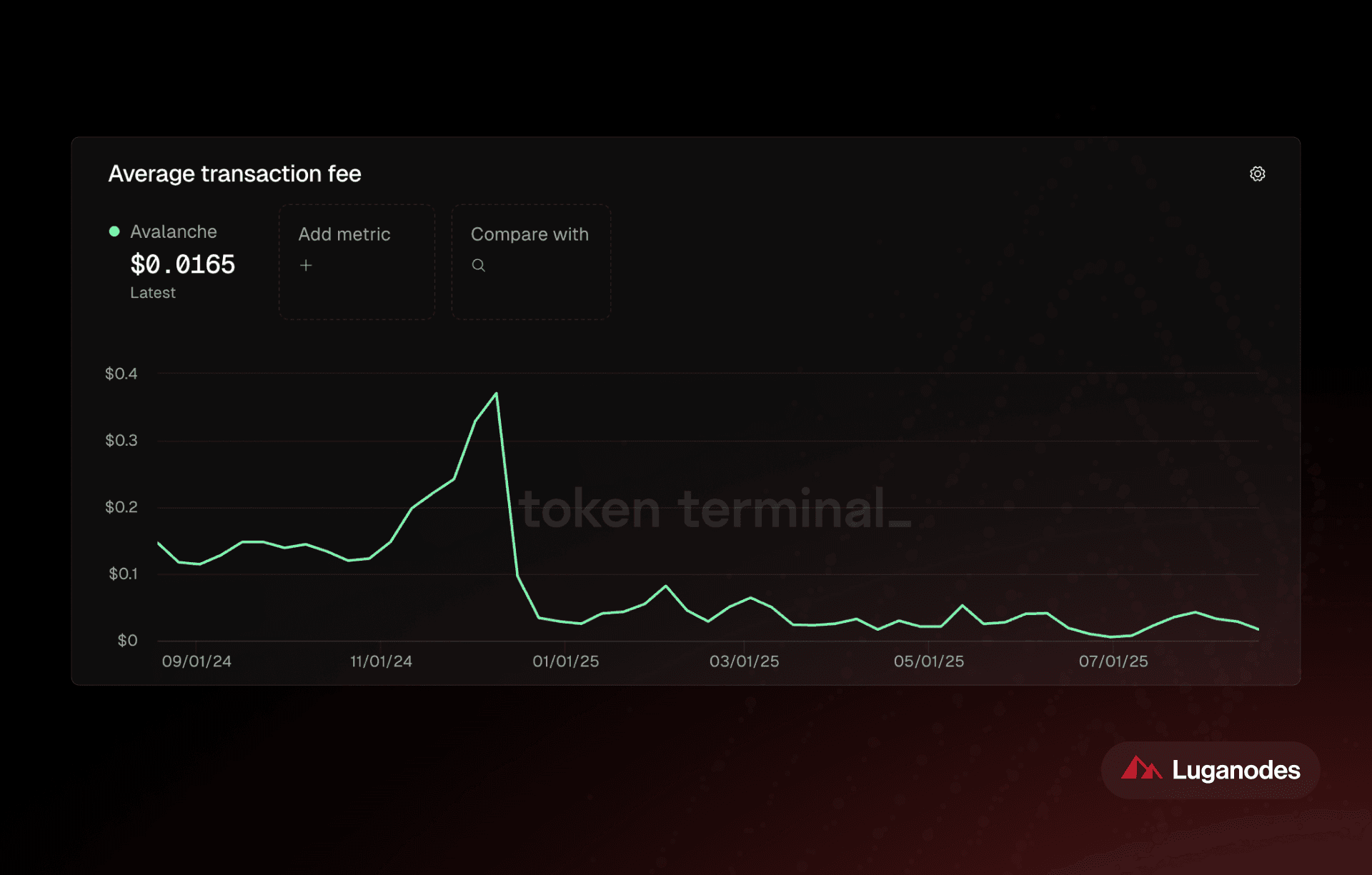

- Cutting Costs: Transaction fees on the C-Chain were lowered from 25 nAVAX to 1 nAVAX (a ~25x reduction), bringing costs in line with leading Ethereum L2s like Arbitrum and Polygon.

-

Expanding Access: ACP-77 introduced a new class of permissionless validators, making it far cheaper to spin up subnets (now branded as Avalanche “L1s”). This removed the prior bottleneck where only permissioned chains could exist.

-

Lowering Barriers: By slashing validator requirements, Etna reduced the cost of subnet creation by an estimated 90%, opening the door to thousands of potential sovereign chains.

In Avalanche’s terminology, the Primary Network itself is considered a subnet, and all new “subnets” are now officially branded as Avalanche L1s. Despite the name, they are not equivalent to Ethereum L2s. Avalanche L1s are fully sovereign blockchains with their own execution rules, but they benefit from the Avalanche validator set and shared infrastructure.

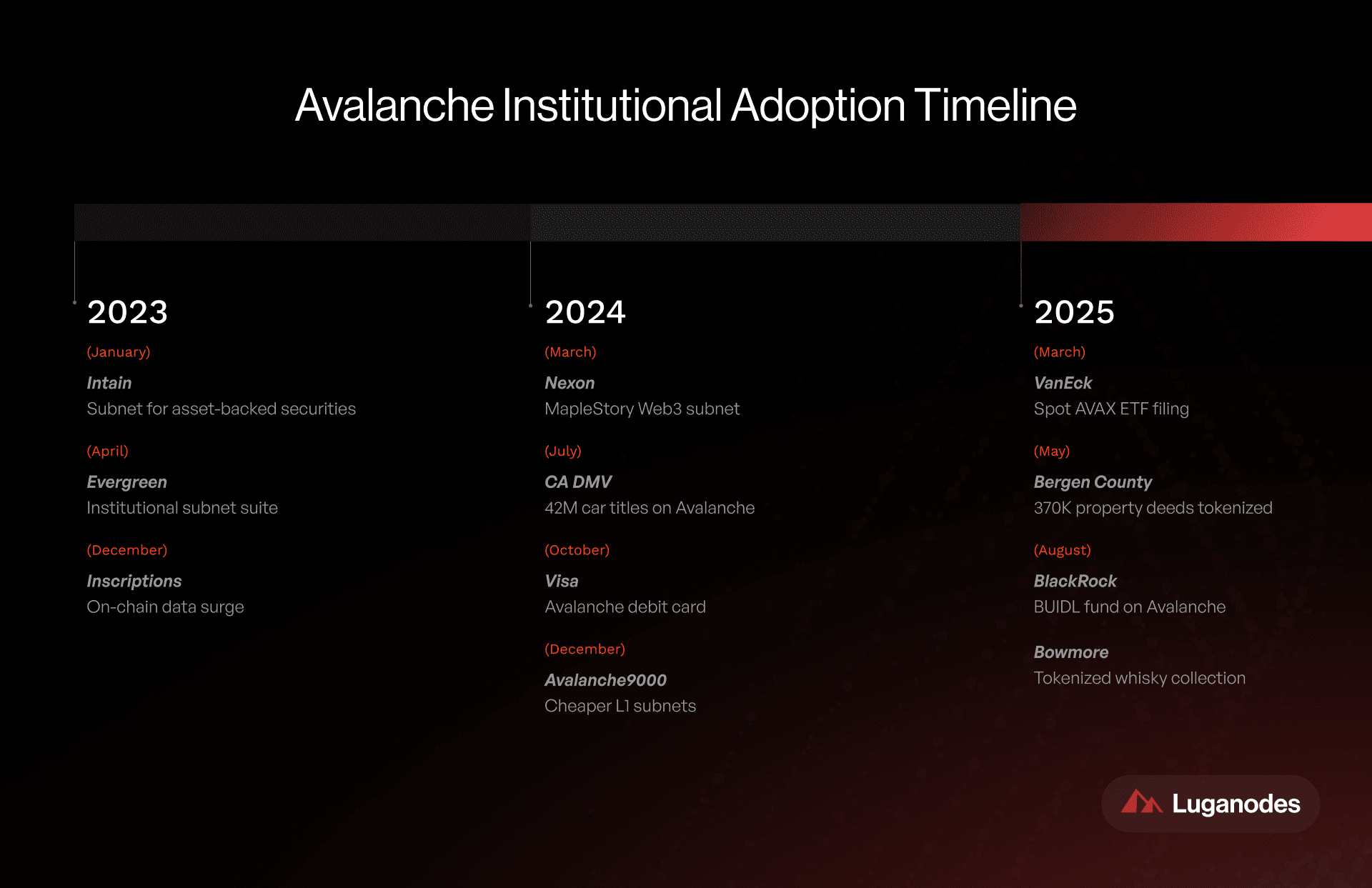

The upgrade also launched Retro9000, a $40M incentive program rewarding developers who experiment with new L1s during testnet and later deploy on mainnet, including $2M earmarked for referrals via business developers and KOLs.

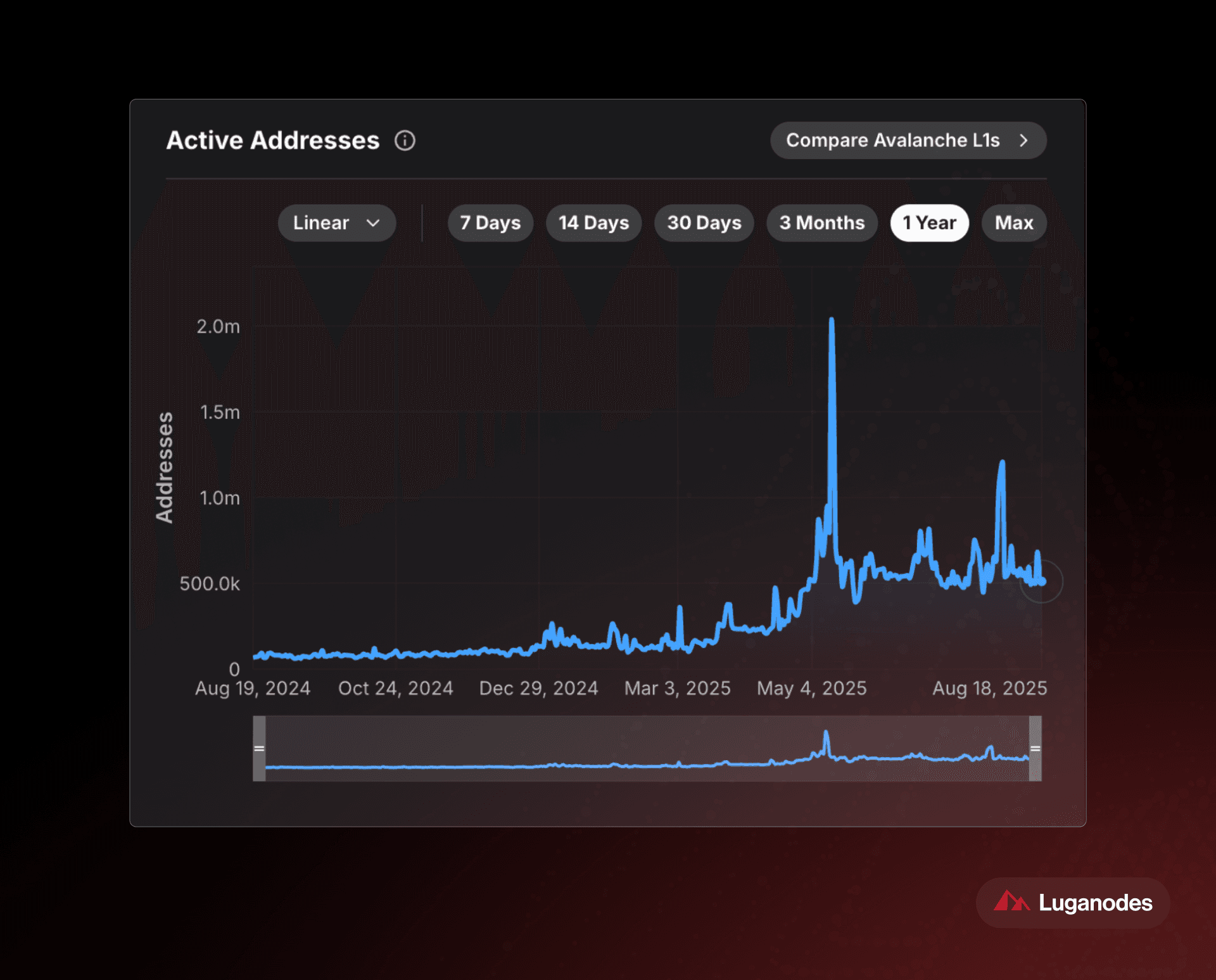

The impact was immediate. Active Avalanche addresses began steadily climbing from December 2024 onward, a trend directly linked to Etna lowering costs and expanding the surface area for experimentation. The proliferation of 300+ Avalanche L1s today can be directly traced back to this moment.

Subnets: From Gaming to Institutions

The true differentiator for Avalanche lies in its Subnet architecture. Built on top of the Primary Network’s X-Chain, P-Chain, and C-Chain, Subnets allow developers to spin up custom Layer 1 blockchains tailored to specific needs.

This modular design has evolved from theory to reality over the past two years, with adoption spanning both consumer-facing industries and institutional finance.

-

Gaming: Titles like MapleStory Universe have launched dedicated Subnets, giving studios full control over tokenomics, fee structures, and virtual machines.

-

Institutional Finance: Ava Labs introduced the “Evergreen” Subnet framework, designed for enterprises requiring KYC/AML compliance within permissioned environments. Landmark examples include VanEck’s tokenized U.S. Treasury fund and BlackRock’s BUIDL fund, both of which leverage Avalanche to bring real-world assets (RWAs) on-chain.

-

Public Sector Experiments: Avalanche has also been deployed at a municipal and state level. In Bergen County, New Jersey, the “Balcony” project used a Subnet to tokenize $240 billion in real estate, cutting deed settlement times from 90 days to just one. Meanwhile, the California DMV began digitizing 42 million car titles on Avalanche in 2024.

These use cases demonstrate that Subnets are not just scaling tools, but also institutional bridges — flexible enough for gaming universes yet compliant enough for Wall Street-grade finance.

C-Chain Activity

While Subnets represent the most high-profile evolution, the C-Chain remains the beating heart of Avalanche’s dApp ecosystem. Over the past two years, usage has climbed dramatically:

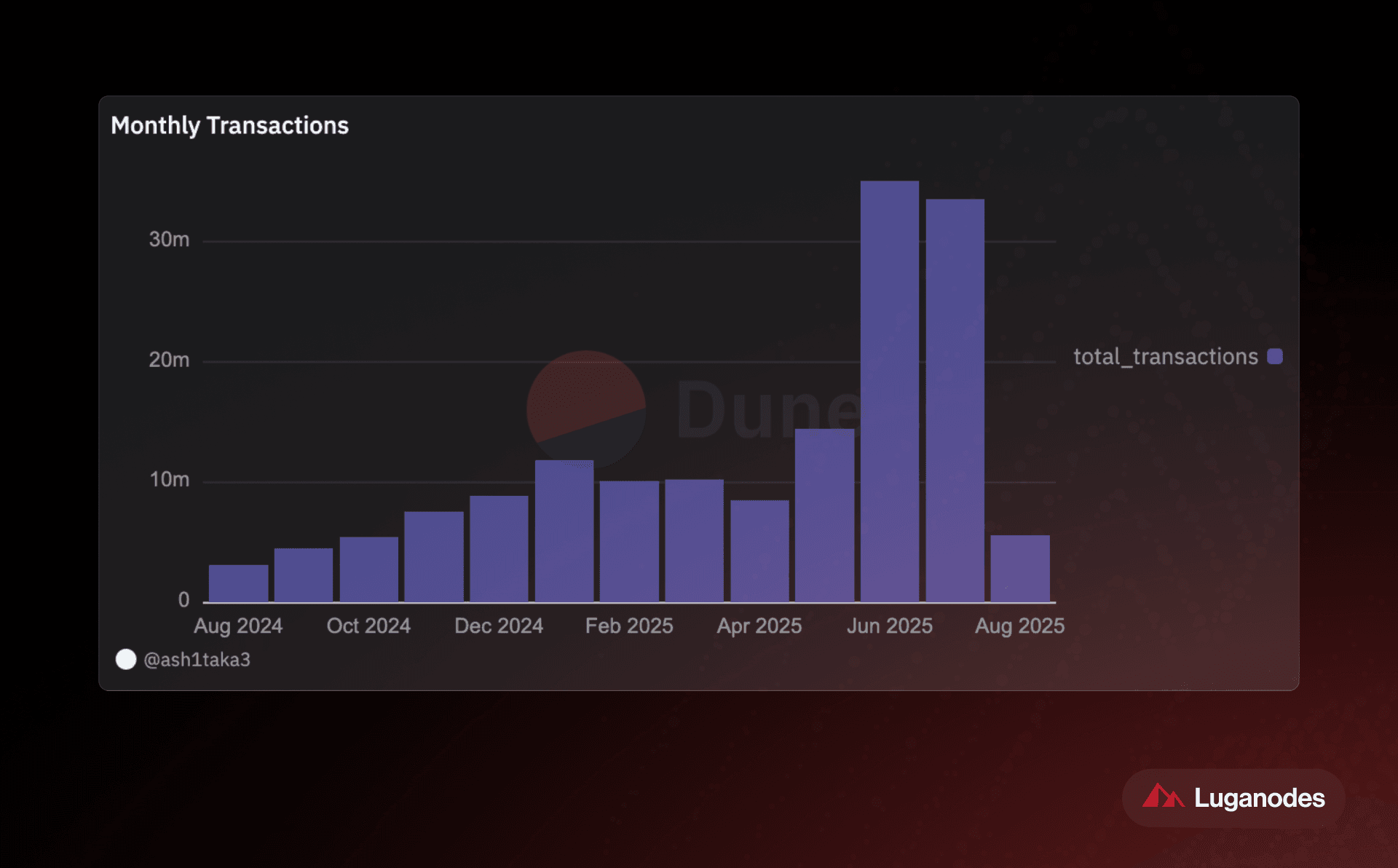

- Transactions: In June 2025, Avalanche hit the highest monthly transaction count. In the following week, the big numbers continued. In fact, 8 July 2025 saw a staggering transaction count of 20M transactions in a single day.

-

Active Addresses: On the same day, active addresses peaked at 950,000, underscoring surging user engagement.

-

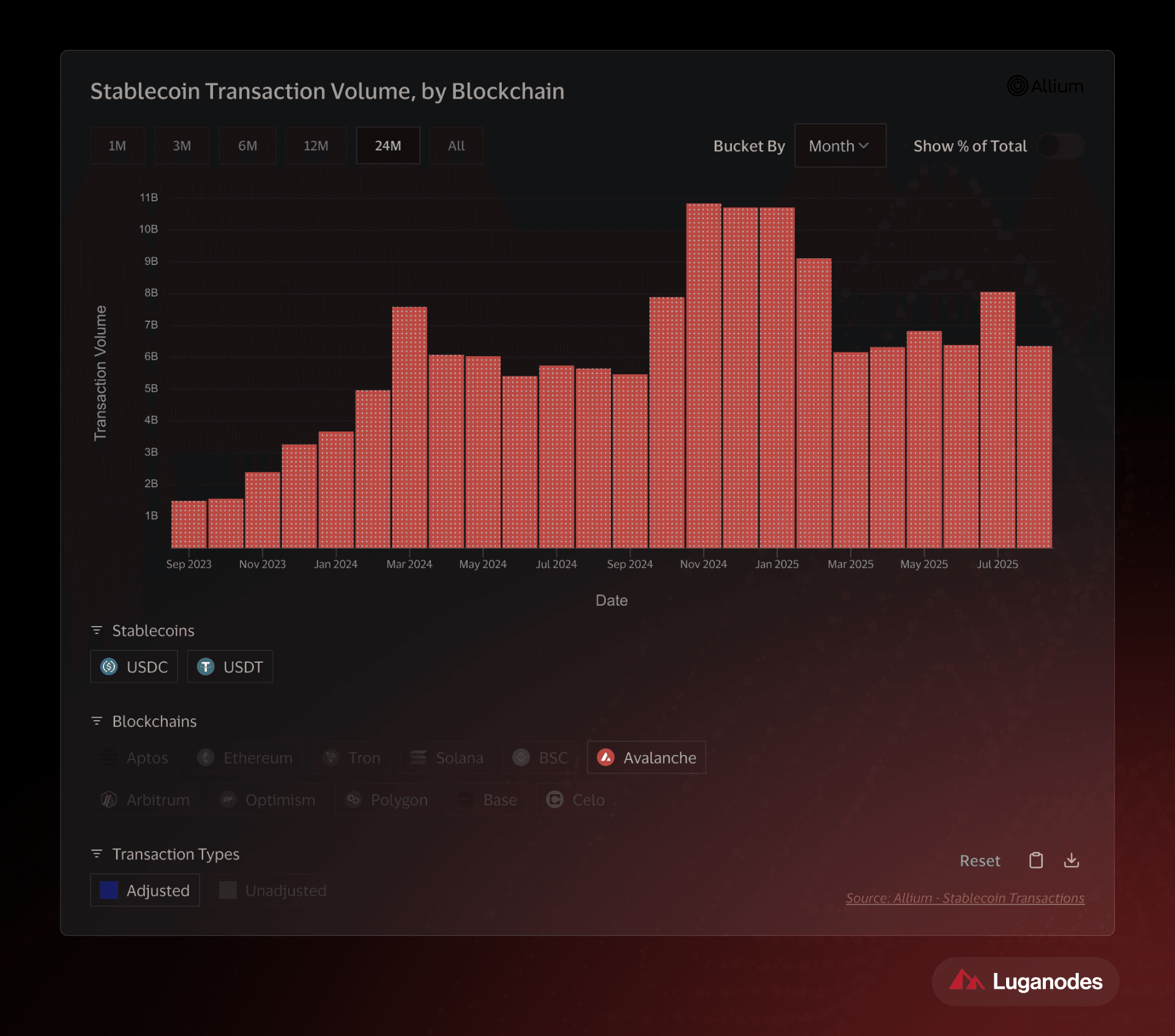

Stablecoins: The total stablecoin supply on Avalanche grew 70% to $2.5 billion between March 2024 and mid-2025 — a clear marker of DeFi adoption.

AVAX Token

The AVAX token remains the backbone of the Avalanche ecosystem, as a medium of exchange and beyond. This asset secures, governs, and sustains the network’s growth.

-

Staking & Network Security:

With nearly 1,500 validators securing the network and over 200 million AVAX staked (more than half the circulating supply, 422M at the time of writing), Avalanche continues to maintain a large validator set. This level of participation signals both security and long-term alignment. -

Deflationary Pressure through Burns:

Avalanche’s unique fee model burns 100% of transaction fees, permanently removing AVAX from circulation. To date, more than 4.6 million AVAX has been burned, equal to about 6.4% of the total supply. During periods of high activity, such as the surge in subnet deployments and transaction volumes in late 2024, monthly burns spiked above 470,000 AVAX. This mechanism ties token scarcity directly to ecosystem usage. -

Institutional Outlook:

The interplay of scarcity, adoption, and technical advancement has caught institutional attention. Standard Chartered, in one of the most high-profile predictions for Avalanche, projects AVAX could reach $250 by 2029.

Taken together, these dynamics reveal a token designed for three functions. AVAX is at once a security layer (via staking), a scarcity engine (via burns), and a growth proxy (its value tied to the expansion of subnets and real-world adoption). Where many networks rely on inflationary tokenomics to incentivize validators, Avalanche has engineered a model where increased usage systematically reduces supply.

The Path Forward: Interoperability, AI, and Ecosystem Growth

Avalanche’s next phase focuses on connecting subnets, enabling new verticals like AI, and accelerating founder pipelines.

-

Interoperability (AWM + Teleporter):

With the Durango upgrade (March 2024), Avalanche activated Warp Messaging (AWM) and rolled out Teleporter, enabling contracts, tokens, and data to move natively across subnets. For users, this means swaps, lending, and payments can route seamlessly across different chains, creating the feel of one unified network rather than siloed apps. This unlocks composability and improves liquidity depth, key to reducing slippage and boosting capital efficiency. -

AI Integration (Youmio & InfraBUIDL):

On July 24, 2025, Youmio announced the first “agent-native” L1 chain on Avalanche, supported by the Foundation’s $15M InfraBUIDL(AI) fund. These chains bring autonomous agents—wallets, bots, and AI-driven services—onchain, generating continuous transactions and collateral demands. For users, this translates into new AI-driven apps that can trade, borrow, or manage assets automatically, expanding the scope of DeFi beyond human inputs. -

Ecosystem Development (Codebase):

Codebase, Ava Labs’ accelerator, continues to onboard early teams. Season 4 applications closed June 6, 2025, with each cohort receiving $50k non-dilutive grants and hands-on support. By fast-tracking DeFi, RWA, and gaming startups, Codebase grows the range of user-facing products, ensuring more diverse ways to earn, transact, and invest on Avalanche.

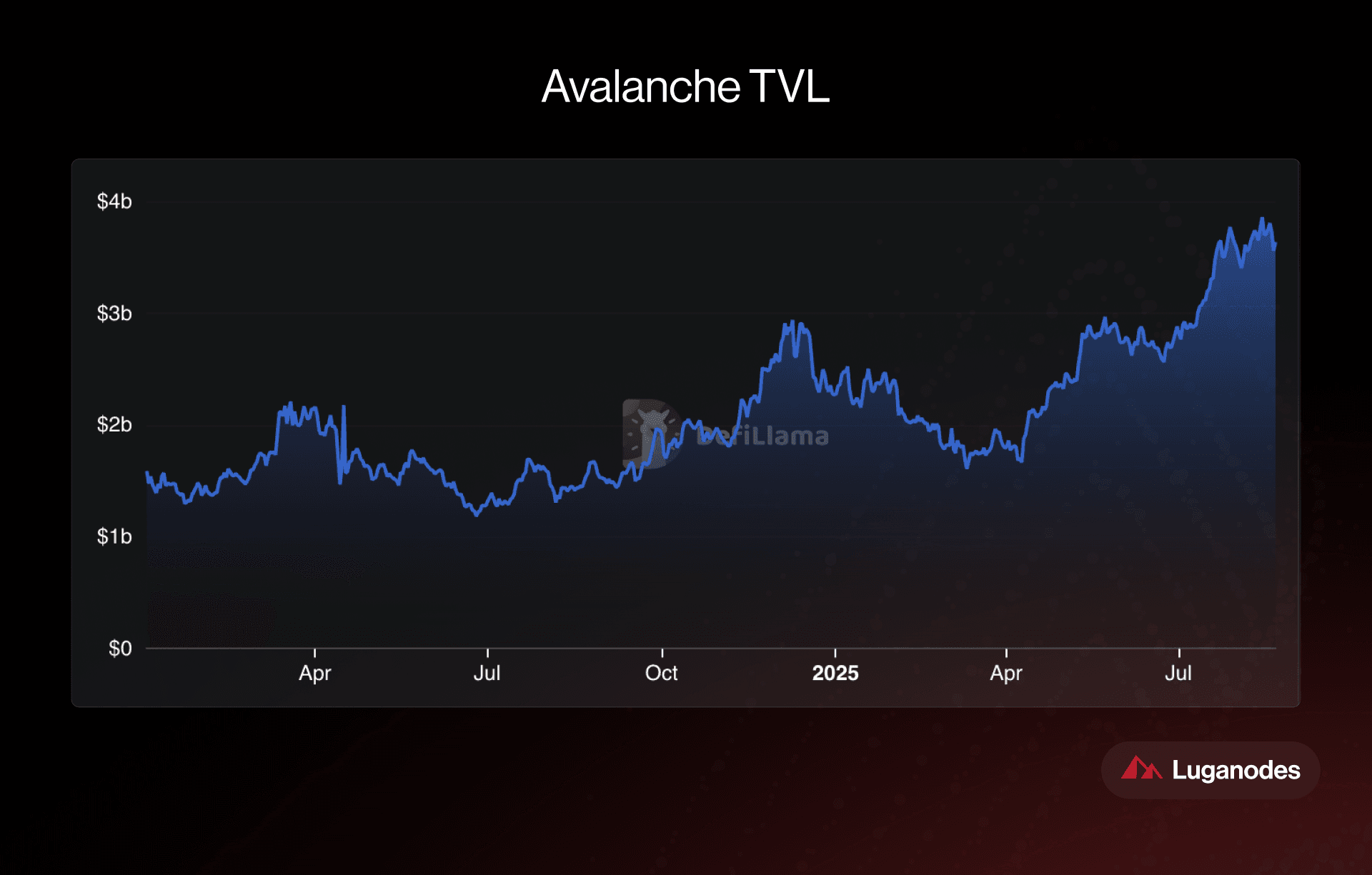

Avalanche DeFi currently holds about $3B+ in TVL, a $1.68B stablecoin cap, and processes ~1.4M daily transactions with ~$400M in 24h DEX volume. These figures show active demand today, which interoperability and AI-native chains are positioned to amplify.

As liquidity flows frictionlessly across subnets and AI chains introduce constant, programmatic activity, users gain cheaper swaps, smarter apps, and deeper yield opportunities, outcomes that will first show up in rising TVL.

Conclusion: Avalanche as an Institutional & Consumer Bridge

In the past two years, Avalanche has successfully transitioned from a promising smart contract platform to a thriving multi-chain ecosystem. The ETNA upgrade proved catalytic, setting off a surge in Subnet adoption that spans gaming, finance, and government infrastructure. At the same time, C-Chain growth and AVAX tokenomics underscore the network’s robustness.

By lowering barriers to entry and providing the flexibility to design sovereign blockchains, Avalanche has positioned itself as a bridge between traditional institutions and decentralized innovation. The next phase will hinge on how well it continues to scale Subnets, deepen institutional partnerships, and expand into new technological frontiers like AI.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.