7 min read

Exploring Liquid Staking: A Look at Lido

Liquid Staking with Lido

In DeFi City, staking continues to be all the rage. Now that the Beacon chain has merged with the Mainnet and Ethereum has moved to a Proof of Stake consensus mechanism, it is inevitable that Staking still has its heydays ahead. While we love highlighting the various charms of staking we must address an underlying problem, something which has caused a hesitation amongst users from going down this investment path — illiquidity.

While staking on Ethereum can provide stable returns, it had an uncertain lock-in period with no ability to unstake. Stakers patiently waited for the recent Shanghai update to finally unstake. While this update has rekindled the interest in staking, it has also reignited the conversations about illiquidity. Another issue often coupled with this argument is that if you aren’t financially capable to meet the minimum stake requirement of 32 ETH, you are not eligible for running nodes as a validator and end up in a staking pool. There have been attempts to circumvent this by using Centralized Exchanges — but since the rules apply to everybody — CEXs cannot stake all the amount since they need reserves to enable withdrawal, hence again not reaping the entire profit.

Amidst the confluence of debates about liquidity issues and peaking interest in staking — a particular protocol has reached $14.389B in Total Locked Value (TVL) (at the time of writing i.e. 8 July 2023), the highest in the DeFi world. Striking when the iron is hot — is Lido DAO, bringing about a Liquid staking revolution.

📈 Lido Analytics: June 26 - July 3, 2023

— Lido (@LidoFinance) July 3, 2023

TLDR:

- Lido TVL grew by 3.84%, ending the week at $14.75b.

- Lido led in net new deposits to Ethereum Beacon Chain - total 7d value of 132.8k ETH.

- The @AaveAave V3 wstETH pool grew rapidly (+9.65%), hitting 347.3k wstETH. pic.twitter.com/7rtzB9jMRE

Liquid Staking — How it’s done

Liquid staking offers a unique solution to the liquidity issue. Token holders stake their cryptocurrency tokens and receive an equal amount of liquid tokens. These tokens, also called staked tokens, derivative tokens or stAsset tokens, represent your ownership of the staked coins and can also be freely traded, transferred, or used as collateral within the ecosystem. This mechanism provides users with access to liquidity while still earning staking rewards.

For example, on staking 2 ETH you receive 2 stETH. The price of stETH (Lido Staked Ether) is pegged to ETH in a 1:1 ratio, though it is susceptible to some market fluctuations. Similarly, for other chains like Polygon, you can stake MATIC and receive stMATIC in return.

Now for the tasty bits — the rewards. The staked ETH keeps generating the staking rewards and therefore the value of each stETH token increases, hence distributing the accrued rewards as per your holdings. Instead of being just a receipt of the staked ETH, stETH acts as a unique value-accruing mechanism.

What to do with my stETH?

Sure, we now have staked our precious ETH and received stETH. And it is gaining value over time. But since there are promises of liquidity, how does stETH facilitate that?

Lido’s Staked Ether tokens can be used for a variety of purposes across many DeFi protocols.

Let’s take a look at some use cases using individual examples for clarity.

- Lending/Borrowing — AAVE — On this protocol, we can utilize stETH or other staked tokens as collateral and borrow or lend tokens. One can take out ETH tokens as a loan against stETH and create a leveraged position or use it for other purposes. One can borrow stETH as a loan, and since the price rises — the loan essentially pays itself off.

- Liquidity Pools — Curve — One can reinvest in liquidity pools — these are specialised pools with multiple types of tokens present in Decentralised Exchanges (DEXs). Adding your tokens here enables more people to buy, sell and swap tokens. As an incentive for providing more liquidity, you earn trading fees and rewards. Curve provides multiple liquidity pools to choose from, one of which is the ETH/stETH-pool. Therefore creating a cycle of liquidity.

- Aggregators — Yearn — This protocol enables users to automatically compound rewards. It utilises the aforementioned Curve liquidity mining program to farm rewards, sell them and reinvest ETH/stETH into its crvSTETH Yearn vault.

Lido DAO — The Governance

While all of this sounds great, there needs to be transparency in governance to make sure that such a project can be secure and responsive to the needs of the community. To address this, Lido has a governance layer called the Lido DAO (Decentralised Autonomous Organization). It is a community-driven organisation that allows LDO token holders to participate in the decision-making process regarding the operation and development of the Lido protocol. LDO token holders can participate in voting on proposals and submit their proposals for consideration.

What’s LDO now? LDO is an ERC20 token that serves as the governance token for the Lido DAO. Holding LDO enables you to vote on protocol parameters and govern the Lido DAO treasury. One can buy LDO from various exchanges; the more LDO one holds, the greater the decision-making powers.

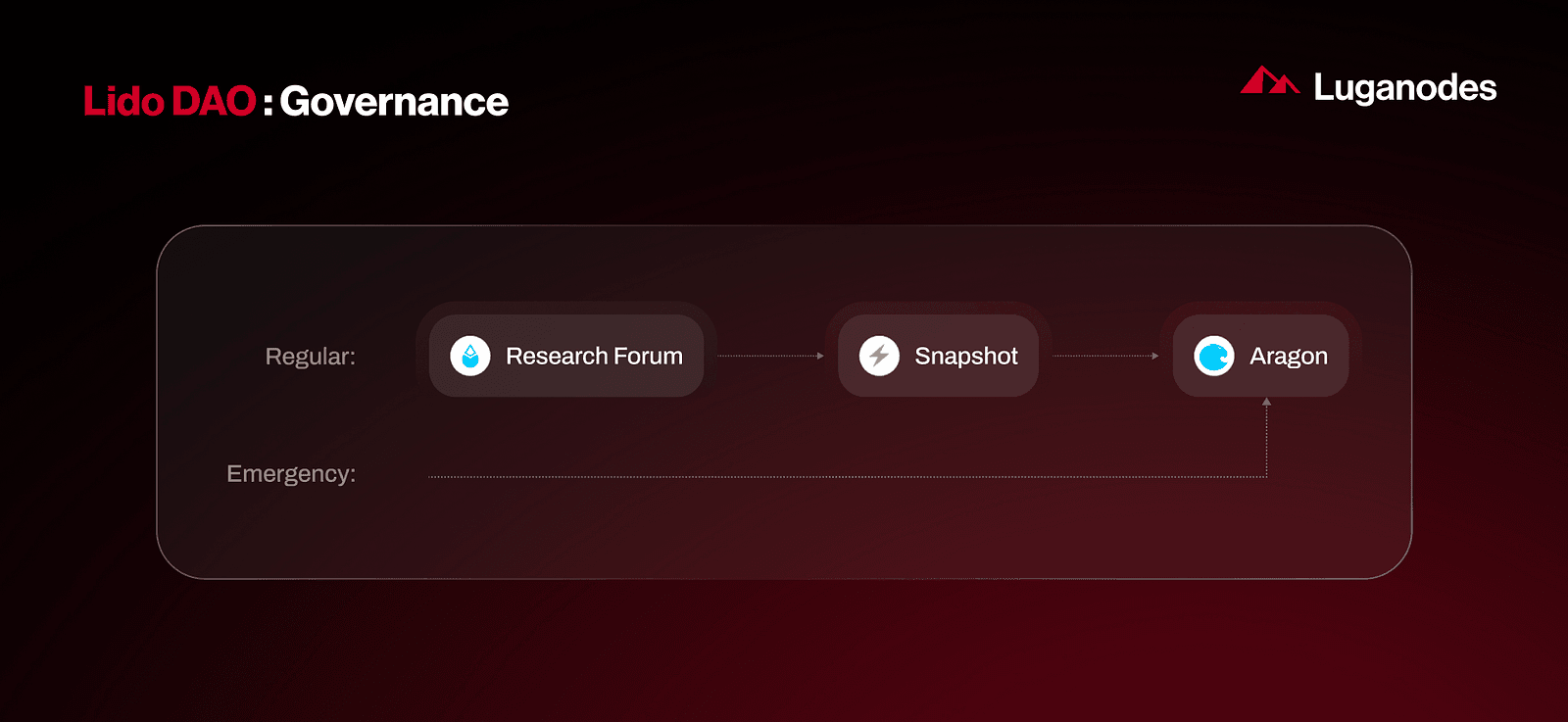

As we know, a DAO is a decentralised authority and hence there is a set process which is followed in the governance process.

For the Regular process track, ideas go into a research forum — which works on the regular system of likes, replies and general discussions. From there we move to a Snapshot voting phase where LDO holders get to vote.

After this, we move on to Aragon, a DAO framework which is committed to freedom, self-sovereignty and decentralisation (The manifesto is quite an interesting read). In the Aragon voting phase, there is on-chain voting on packages called “Omnibuses” — they are essentially multiple proposals rolled into one for ease.

Apart from the regular track, there is an emergency track which involves a direct move to Aragon, skipping other steps — reserved only for special circumstances.

Beyond the Merge

Now that the Merge is complete, one might certainly wonder — what value does Lido hold when withdrawals are enabled in the next hardfork? Certainly, an important benefit offered will cease — but with the current adoption and use, Lido is here to stay — playing the same part, in a different context. Even after withdrawals are enabled — there will always be a queue of validators exiting and entering the chain, the queue being an essential security feature. So stETH will be the fastest way to enter or exit a staked position on the Ethereum chain. Moreover, other chains where withdrawals are possible — still have timing considerations; this is where instant liquidity again becomes a requirement. For example, Solana, behold — we also have stSOL for that.

Conclusion

Lido’s effort in finding a problem, creating a solution and bringing it to the masses is commendable. An issue faced by the public now has a fix which is being governed by a decentralised entity. If anything, Lido’s work in this space is an exemplar of the DeFi way.

Following a successful on-chain vote, Lido V2 is officially here.https://t.co/36EmuagToD

— Lido (@LidoFinance) May 15, 2023

🏝️ pic.twitter.com/sl4kjNpUYw

Lido continues to make steady progress with the launch of Lido V2 — which among other things allows exchanging stETH for ETH and the introduction of a staking router, a protocol update. At the time of writing this, Lido is the most valued Protocol and the usage of stETH continues to expand in the DeFi ecosystem with meaningful collaborations, and community participation. We are ecstatic to see what the future holds for liquid staking, and staking in general.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.