Guides

3 min read

Staking INIT tokens and adding Liquidity with Luganodes

Initia Staking and Liquidity Provision Guide

Published on

April 29, 2025

Introduction

Welcome to the $INIT staking and liquidity provision guide! This walkthrough will help you stake your INIT tokens and optionally provide liquidity through Initia’s enshrined liquidity system—all while supporting the network with Luganodes, a top-tier validator.

Initia is redefining the appchain experience with its Interwoven Stack, making opinionated decisions on key infrastructure like interoperability, oracles, and data availability. This allows developers to focus on innovation while the stack handles fragmentation and accessibility.

Validator Details

Validator name: Luganodes

Address: initvaloper14pslrmhz2w4ufjlup4s53zsapwv269lv7agf9z

Explorer: https://scan.initia.xyz/interwoven-1/validators/initvaloper14pslrmhz2w4ufjlup4s53zsapwv269lv7agf9z

Step-by-Step Staking Process

Step 1: Access the Initia Staking Dashboard

- Head over to the Initia Staking Dashboard.

- Click on "Connect Wallet" and choose your preferred wallet. In this guide, we’ll be using Keplr.

Step 2: Choose Asset & Enter Staking Amount

-

Select the asset you wish to stake—INIT in this case.

-

Enter the amount of INIT tokens you want to stake.

Step 3: Select Your Validator

- From the list of validators, choose Luganodes for institutional-grade infrastructure and uptime.

Step 4: Select Lock-In Period

-

Use the slider to choose your preferred lock-in period.

-

A longer lock-in increases your VIP gauge voting power multiplier.

Step 5: Confirm and Approve

-

Review your choices and click "Confirm".

-

Approve the transaction in your Keplr wallet.

Step 6: Track Your Stake

-

You can confirm your stake on InitiaScan.

-

Navigate to the “My Page” section to view your overall assets.

Adding Liquidity & Staking LP Tokens

Initia’s enshrined liquidity allows you to contribute to chain security and liquidity simultaneously—staking LP tokens to earn dual rewards.

Step 1: Provide Liquidity

- Go to the “My Page” section and click on “Provide Liquidity”.

-

Select a liquidity pool. For this guide, we’ll use the USDC-INIT pool.

-

Click on “Stake”, then choose to deposit both tokens or a single asset (we’ll use INIT only).

- Select the amount of INIT to deposit and approve the transaction in your wallet.

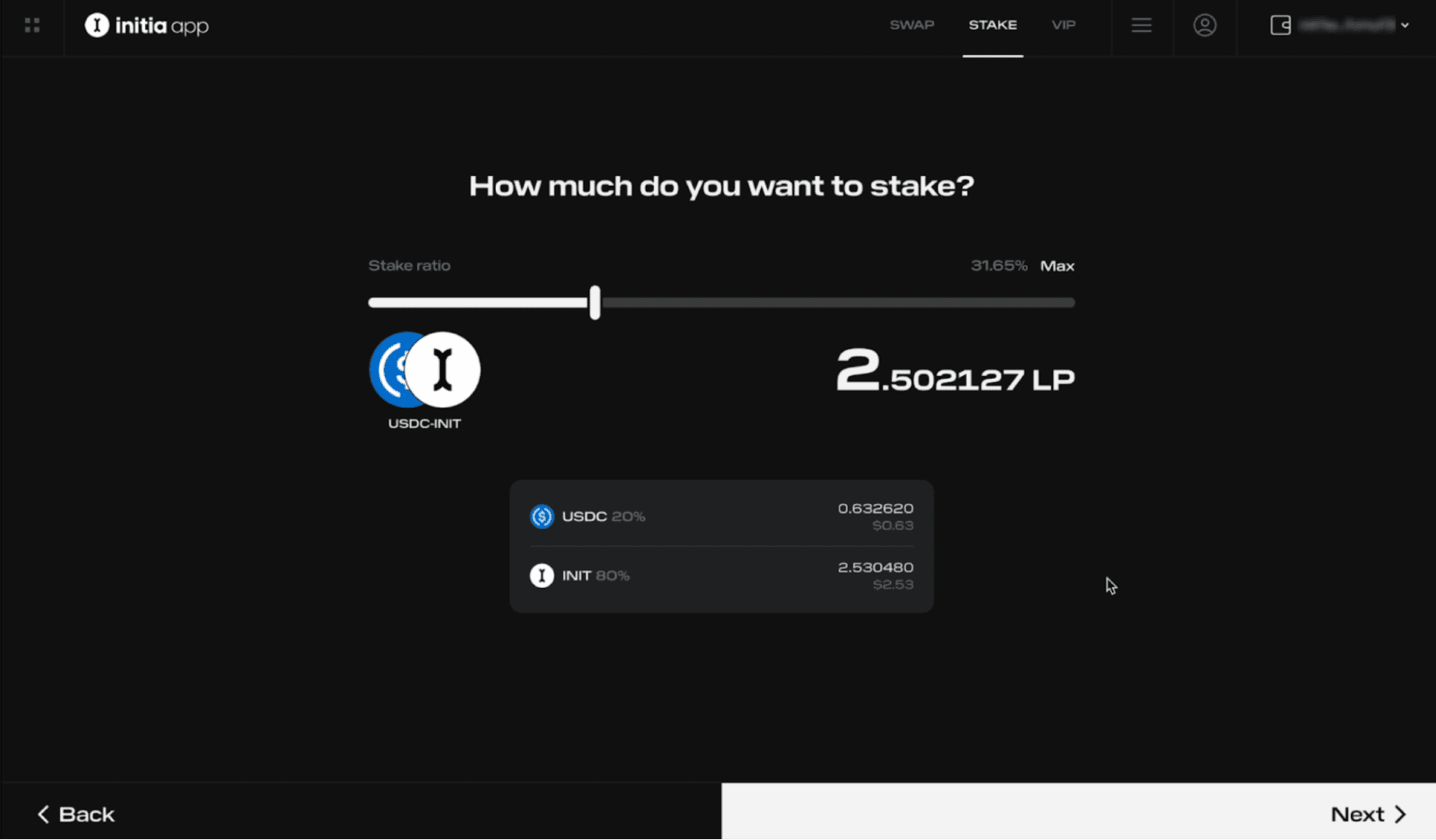

Step 2: Stake LP Tokens

-

Return to the Liquidity section.

-

Click on “Stake” next to your provided liquidity.

- Use the slider to choose the portion you wish to stake.

- Select Luganodes as your validator.

- Set your lock-in period using the slider.

- Confirm and approve the transaction.

Step 3: Track Your Positions

-

Navigate to “My Page” to see:

-

Total INIT assets

-

Liquidity provided

-

Liquidity staked

-

Locked stake

Conclusion

You’ve successfully staked your INIT tokens and optionally contributed liquidity—all while supporting Initia’s network security through Luganodes. With Luganodes' institutional-grade infrastructure and Initia’s innovative reward model, you're helping build the future of composable, appchain-driven Web3.

For any questions or support, don’t hesitate to reach out to the team!

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.