Network

9 min read

Ether.fi: Mission to Mainstream DeFi

Eliminating Needless Complexity

Published on

July 23, 2025

Introduction

Ether.fi started as a next-generation liquid staking protocol. However, that is not where the story ends. Its longer-term goal is to help onboard hundreds of millions of new users into the crypto ecosystem, more specifically, DeFi. To achieve this goal, DeFi must be both safe and easy for everyday people to use. The ability to save, earn, and spend cryptocurrency in the real world must be a straightforward process.

Ether. Fi's team believes that their suite of three integrated products — Stake, Liquid, and Cash — can usher in the long-awaited DeFi banking platform that's easy to use.

This article will focus on Ether.fi's journey, its product suite, and how it plans to onboard millions of new users to DeFi.

The Challenge of Needless Complexity

In a recent interview with Ether.fi founder Mike Silgadze, "The Crypto Company That Will Replace Visa ft. Ether.fi," he stated that one of DeFi's issues is the tendency to get "nerd sniped." In other words, the more complicated a new DeFi project is, and the harder it is to understand, the more excited people get.

Complexity excites engineers, it excites the VCs, the community gets excited, and before you know it, complexity becomes a self-reinforcing prophecy. It's as if creating value takes a back seat.

Silgadze wanted to do things differently. From Ether.fi's beginning, building a large platform to onboard "normal" people into DeFi drove the agenda.

Complex financial protocols work well for power users. In the early days of computers, power users were happy to buy a motherboard, a video card, a sound card, and assemble their own computer. Likewise, early DeFi power users navigate a variety of wallets, seed phrases, and exchanges. However, just like computers evolved to the point where normal users could own them, Silgadze envisions a vertically integrated DeFi platform that non-technical people can use.

The Journey

Ether.fi started as a hedge fund. Its founder previously exited a startup before getting involved with yield farming. During DeFi summer, the innovative products popping up motivated him to become a creator as well.

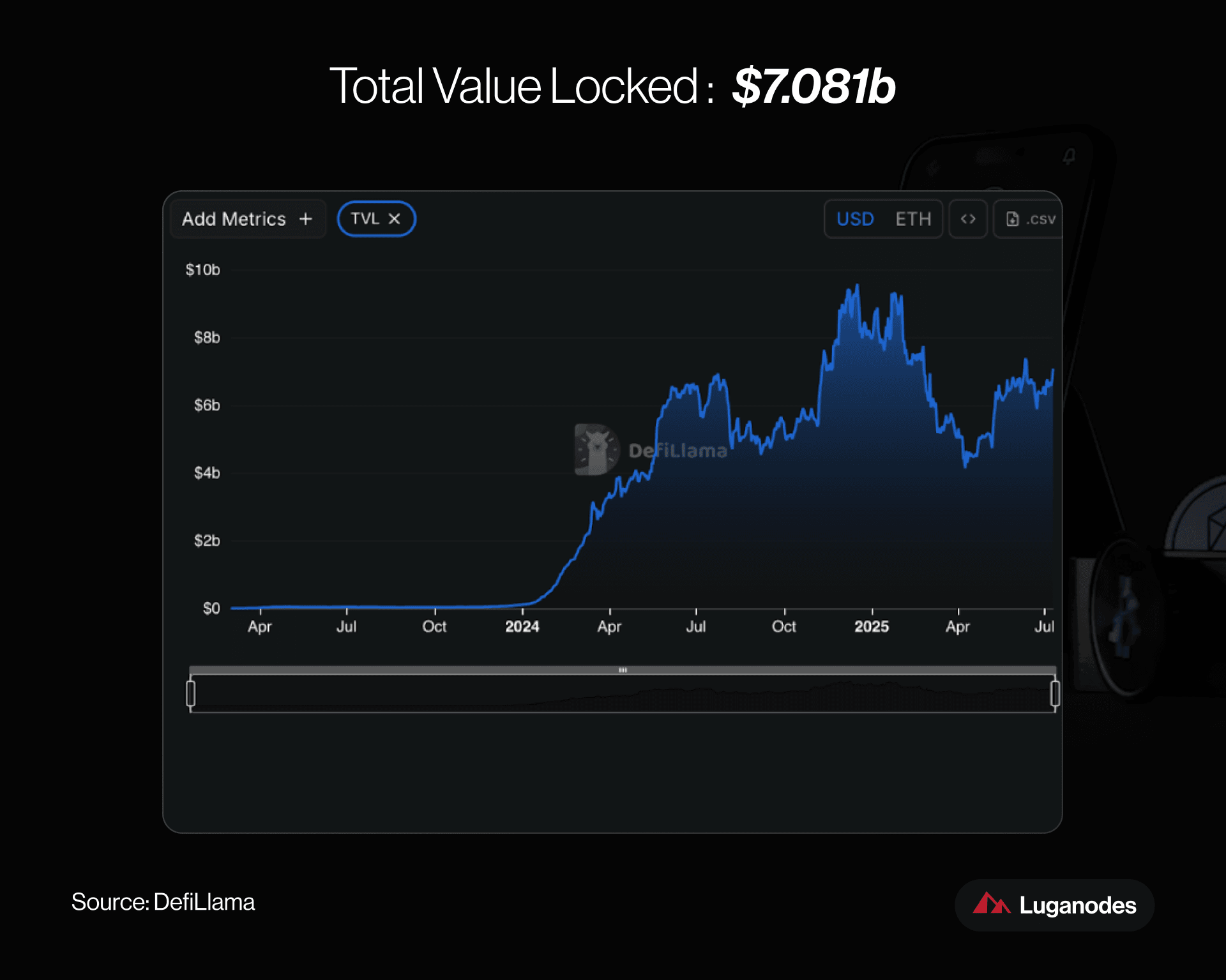

Starting a fund was the natural next step. So, Silgadze created multiple funds, one being a staking fund. Since staking blossomed into the largest category in DeFi (in terms of TVL), he decided to build a next-generation staking product. Then, after running the fund for about a year, Silgadze converted it into what would become Ether.fi Stake.

The Crypto-Native Banking Alternative

Ether.fi is now a DeFi bank—a crypto-native banking alternative. It's what Silgadze calls "the holy grail of DeFi." Although this was the original idea, it only became possible with the advent of the latest tooling and technology.

An opportunity arose for Ether.fi because narrow point solutions, such as borrowing and lending platforms or DEXs for swaps, proliferate the DeFi landscape. Silgadze wanted to go beyond the conventional and build a vertically integrated DeFi platform.

"What we built is a DeFi bank. It's not a traditional bank, but a banking alternative that is entirely on-chain. It's self-custodial but gives you all the functionality you'd expect from a Fintech bank."

A DeFi bank affords you the ability to save money, pay bills, invest in crypto assets, utilize real-world assets, wire money, spend, borrow, and enjoy numerous other features.

Building a DeFi Bank

Silgadze is betting that regular users will gravitate towards a DeFi bank rather than the traditional crypto exchange. He believes that most people don't want products where accidentally clicking the wrong button means losing all their funds. Knowing this, the Ether.fi team deliberately spent extra time putting the necessary tech in place to make the user’s life easier.

They are also obtaining the necessary financial licenses to conduct transactions directly. In the meantime, Ether.fi is partnering with other companies to plug into TradFi in a compliant manner.

Silgadze estimates that within a few months, crypto natives will confidently send Ether.fi products to their friends and family outside of the crypto world, without worrying about complexity issues. They can sign up and deposit money without feeling like they're dealing with a crypto network.

The team looks forward to the day when 100 million users onboard to Ether.fi. However, ramping up to five to six million users is the prerequisite milestone. Ether.fi must first secure the DeFi natives, with the ultimate goal of attracting mainstream users. It took Visa 50 years to achieve the level of coverage it has today. Perhaps Ether.fi can reach it in 10 years, but it will take time.

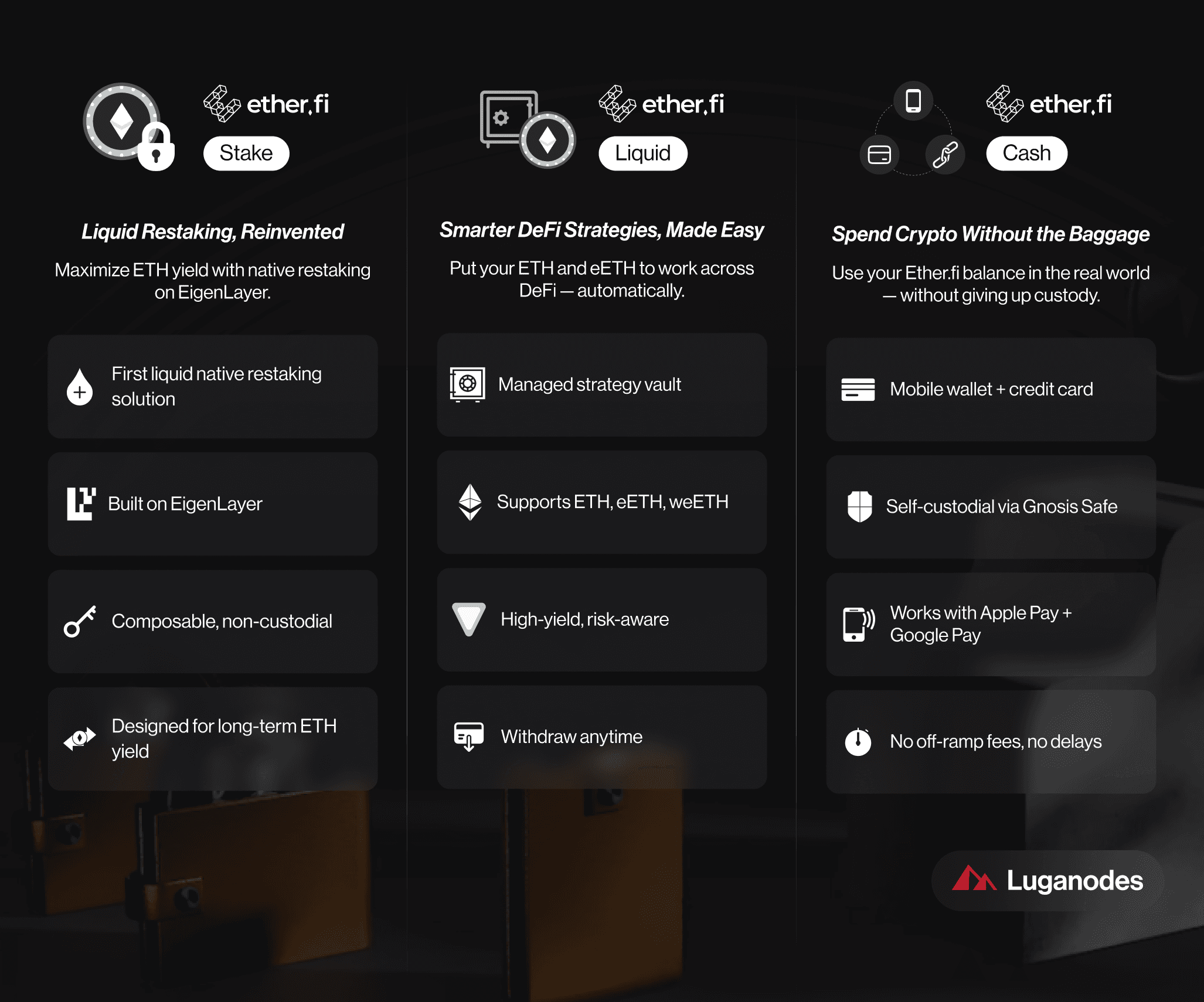

Ether.fi's growth phases include staking, growing TVL, and growing the user base. In doing so, the team has launched Ether.fi Stake (the staking product), Ether.fi Liquid (a DeFi strategy product), and Ether.fi Cash (a wallet and credit card product).

With Ether.fi you save with Stake, invest with Liquid, and spend with Cash without leaving crypto for any fiat rails. "Fiat rails" refers to the infrastructure that facilitates the transfer of fiat currency. Let's examine each of these products in more detail.

Introducing Ether.fi Stake

Ether.fi Stake is the first liquid, native restaking solution. This product makes it easy to restake ETH on EigenLayer.

The team views restaking as the next generation of staking, as ETH staking yields should continue declining as more ETH is staked. Since staking yield will be spread over a larger amount of staked ETH, most of the long-term rewards will come from restaking.

Ether.fi Liquid

The next product is Ether.fi Liquid. It is a managed DeFi strategy vault. It puts your ETH, eETH (Ether.fi's liquid restaking token), or weETH (Ether.fi's wrapped version) to work in DeFi to earn the highest rewards while also managing risk. You can withdraw your assets from these non-custodial strategy vaults at any time.

What Is Ether.fi Cash?

Ether.fi Cash is a real-world spending account. It allows you to spend and borrow against your Ether.fi balance. This product includes a mobile app wallet that connects to your Ether.fi account. You also get a credit card you can load with your Ether.fi balance. Additionally, you can keep your coins on-chain and swipe whenever you need to spend with the Cash card.

Ether.fi Cash allows you to attach credit cards and borrow and spend money. You can utilize built-in virtual bank accounts to wire money into. Furthermore, all of Ether.fi Cash's credit card tiers allow you to collect Cash Points as you use your card. It also works with Apple Pay and Google Pay.

This product addresses a significant pain point for DeFi users, specifically the crypto-to-fiat off-ramp. DeFi users traditionally off-ramp by depositing their crypto assets to a centralized exchange before withdrawing them to their fiat bank account. But the question is, why bother using DeFi if you're just going to use a centralized exchange anyway? That's where Ether.fi Cash comes in.

The goal is to remain strongly self-custodial and decentralized while keeping things simple for users. From day one, the goal was eliminating product complexity. The trick was finding a way to stay true to decentralized, crypto principles without adding the traditional crypto baggage such as seed phrases, and forcing users to sign transactions and approvals.

All the cross-chain capabilities work, as does support for multisig and hardware wallets; however, the team has abstracted away all the complexity. The Cash product feels like an app. You just click and it works.

Introducing Gnosis Safe

Traditional crypto credit cards keep custody of your funds (at least shortly before you make a transaction). Then, you manually convert your cryptocurrency to fiat or transfer funds to a non-custodial wallet to process transactions.

When you use your Ether.fi Cash card, funds are pulled from your Gnosis Safe without gas or off-ramp fees. Furthermore, you don't have to wait the typical three to five business days for your off-ramped funds to arrive before you can spend them.

Moreover, unlike crypto-based credit cards, you don't top up Ether.fi Cash with fiat. Nor do you rely on slow bank transfers like with traditional credit and debit cards. Gnosis Safe holds your Ether.fi assets while ensuring your complete control of your funds at all times.

Ether.fi Cash is the only pure, non-custodial solution to the crypto-to-fiat bridge. It simplifies the process of spending crypto. However, the Cash product is still in its early stages of development, so expect it to continue evolving over the coming months.

Ether.fi - Summary

Mike Silgadze is pleased with the direction the Ethereum ecosystem is moving. However, he's not so happy with the traditional fiat system. When it collapses, we will need a "Noah's ark standing by." The team plans for Ether.fi to be that ark with its three products: Stake, Liquid, and Cash.

Additionally, DeFi needs to become more accessible for everyday people to participate. Thus, the long-term vision for Ether.fi is to make it easy for normal people to onboard and bring the dream of hundreds of millions of new users to fruition.

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.