Update

3 min read

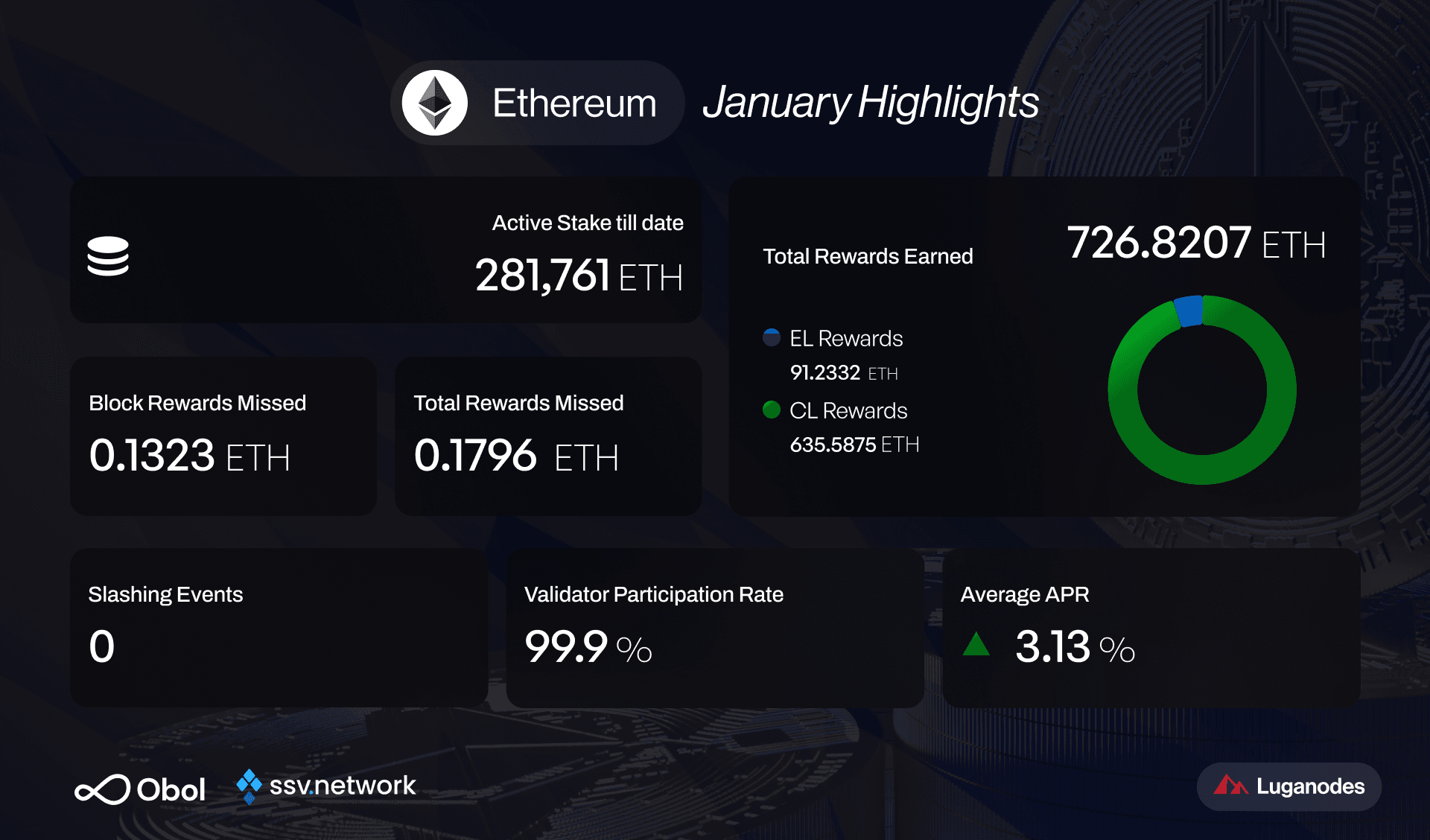

Luganodes Ethereum Validator Report – January 2026

Uptime, rewards distribution, and APR performance

Published on

February 10, 2026

Description

Ethereum staking activity remained strong through January, with Luganodes sustaining high validator effectiveness and stable infrastructure performance. Consensus Layer rewards continued to form the foundation of staking returns, while Execution Layer fees and MEV provided meaningful upside. With zero slashing events and minimal missed rewards, January reflected another month of reliable, institutional-grade validator operations.

1. Introduction

Ethereum validators continued to play a critical role in maintaining network security and finality throughout January. Luganodes operated with high participation and strong execution metrics, supporting Ethereum’s decentralization while delivering consistent staking performance.

This report summarizes Luganodes’ Ethereum validator performance and staking rewards for January 2026, based on aggregated Rated Network data.

2. January Highlights

Active Stake: 281,761 ETH

Validator Participation Rate: 99.9%

Average APR: 3.13%

Total Rewards Earned: 726.8207 ETH

Consensus Layer Rewards Earned: 635.5875 ETH

Execution Layer Rewards Earned: 91.2332 ETH

Block Rewards Missed: 0.1323 ETH

Total Rewards Missed: 0.1796 ETH

Slashing Events: 0

3. Total Rewards Earned

Luganodes validators earned a combined 726.8207 ETH during January.

-

Consensus Layer (CL) Rewards: 635.5875 ETH (~87%)

-

Execution Layer (EL) Rewards: 91.2332 ETH (~13%)

Consensus rewards continued to provide predictable, stable returns, while execution rewards reflected transaction demand, block proposals, and MEV opportunities.

4. Validator APR

Average validator APR for January stood at 3.13%, reflecting favorable network conditions and strong validator effectiveness.

Consensus activity remained the primary source of yield, with EL rewards contributing incremental upside. APR variability remains tied to validator set size, blockspace demand, and block proposal frequency.

5. Validator Performance

Participation Rate: 99.9%, reflecting strong uptime and consistent execution.

Effectiveness & Accuracy:

-

Source vote accuracy: 99.92%

-

Target vote accuracy: 99.87%

-

Head vote accuracy: 98.88%

-

Proposal miss rate: 0.06%

Slashing: No slashing incidents were recorded during January.

6. Rewards Breakdown

Consensus Layer (CL)

-

635.5875 ETH earned from attestations and validator duties

-

Remains the most stable component of staking rewards

Execution Layer (EL)

-

Priority fees earned: 19.4445 ETH

-

Baseline MEV collected: 71.7886 ETH

-

Total EL rewards: 91.2332 ETH

Missed Rewards

-

Total rewards missed: 0.1796 ETH

-

Block rewards missed: 0.1323 ETH

Missed rewards remained minimal relative to overall validator performance.

7. Risk-Adjusted Rewards

Luganodes continues to prioritize risk-adjusted performance through slashing avoidance, optimized proposer execution, multi-client operations, and continuous monitoring. This approach supports consistent returns without exposing delegators to unnecessary operational risk.

8. Institutional Staking with Luganodes

Luganodes provides non-custodial Ethereum staking designed for institutions, custodians, and long-term holders, with real-time dashboards, API integrations, detailed rewards reporting, and enterprise-grade support.

9. Conclusion

January demonstrated Luganodes’ ability to deliver strong validator performance at scale, with high participation, competitive APR, minimal missed rewards, and zero slashing events.

Luganodes remains committed to supporting Ethereum’s decentralization while delivering secure, consistent, and institutional-grade staking outcomes.

👉 For Ethereum staking inquiries, contact hello@luganodes.com

About Luganodes

Luganodes is a world-class, Swiss-operated, non-custodial blockchain infrastructure provider that has rapidly gained recognition in the industry for offering institutional-grade services. It was born out of the Lugano Plan B Program, an initiative driven by Tether and the City of Lugano. Luganodes maintains an exceptional 99.9% uptime with round-the-clock monitoring by SRE experts. With support for 45+ PoS networks, it ranks among the top validators on Polygon, Polkadot, Sui, and Tron. Luganodes prioritizes security and compliance, holding the distinction of being one of the first staking providers to adhere to all SOC 2 Type II, GDPR, and ISO 27001 standards as well as offering Chainproof insurance to institutional clients.

The information herein is for general informational purposes only and does not constitute legal, business, tax, professional, financial, or investment advice. No warranties are made regarding its accuracy, correctness, completeness, or reliability. Luganodes and its affiliates disclaim all liability for any losses or damages arising from reliance on this information. Luganodes is not obligated to update or amend any content. Use of this at your own risk. For any advice, please consult a qualified professional.